Gartner Managed File Transfer Magic Quadrant

Ten 15 years old today!

Time to Read: 6 Minutes

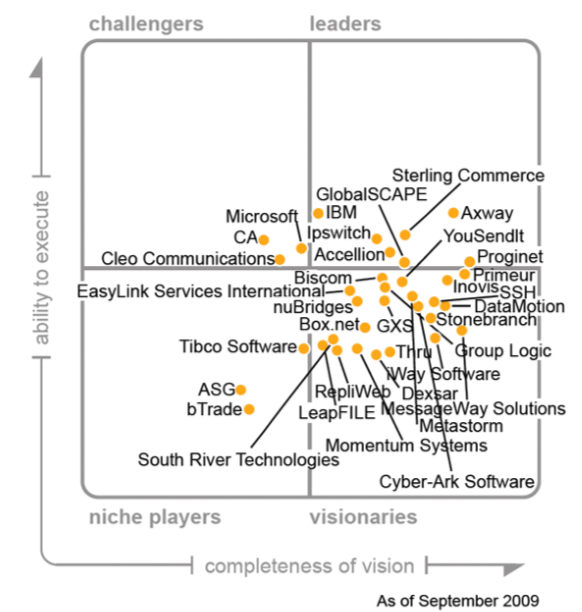

Gartner are globally known for their research reports, so it’s no surprise that enterprises still canvas their opinion when considering a new Managed File Transfer (MFT) solution. However, many years have passed since Gartner’s Frank Kenney, someone I’ve got to know well over the years and very much respect his opinions on all things file transfer, focused on this sector and somewhat unbelievably it has been 15 years since the release of the Gartner Managed File Transfer Magic Quadrant.

When it was released it gave many vendors with whom we now work, a new phrase to represent or categorise their software: Challenger, leader, niche player or visionary.

Fifteen years is a long time in any marketplace but in enterprise software, where things move rapidly, it is a lifetime. What was true when the original report was written, has been drastically re-written, and if Gartner were to rewrite their Gartner Managed File Transfer Magic Quadrant the list of vendors would be considerably different.

Today MFT falls under the broader spectrum of integration at Gartner, and in wanting to better understand their appreciation of the space, Pro2col became a Gartner client providing us the opportunity to speak with each of the three analysts covering MFT. Pro2col learned that Gartner no longer cover the MFT industry, providing our team the opportunity to update them on the sector. Even their Gartner Market Snapshot of Managed File Transfer is outdated and encompasses vendors that may not strictly fall under the MFT category.

If you’re short on time and want to understand what the latest position is regarding MFT software, you can review our comprehensive, comparative analysis of the current vendors in our report of the ‘Top MFT Software Tools to Consider’. It details the top 15 vendors, providing key facts, advantages, considerations, and features of their MFT software solutions.

Gartner’s Managed File Transfer Magic Quadrant comprised of a collection of vendors with products which had file transfer capabilities but wouldn’t meet today’s classification of an MFT tool. It included a variety of solutions which would fall into the category of Enterprise File Sync & Share (EFSS) also known as Content Collaboration Portal (CCP), and tools that have become better known as Secure Email or Ad Hoc file sharing.

Of the thirty-five vendors listed only twelve of them are considered Managed File Transfer vendors by today’s classification, another ten are now End of Life (EOL) with no software updates for a minimum of two years. Another seven vendors fall into the EFSS and Ad Hoc file sharing categories, with the remaining six vendors having limited file transfer capabilities.

So, what’s happened to those represented in the Gartner Managed File Transfer Magic Quadrant of 2009? Below is our summary.

Further Reading:

Vendors featured on the 2009 Gartner Managed File Transfer Magic Quadrant

Shortly after this report was released IBM acquired Sterling Commerce from AT&T for $1.4B in cash. At the time it was reported that Sterling had 18,000 customers worldwide.

Now part of the Fortra portfolio of companies, Globalscape is still a cornerstone of the MFT marketplace. Their business strategy was completely realigned after some turmoil in 2018 and the tragic death of its CEO in 2019. A result of the changes, the company has experienced accelerated growth, however, product development has slowed in recent years.

Microsoft SharePoint Workspace, previously known as Microsoft Office Groove, is a discontinued desktop application designed for document collaboration in teams with members who are regularly off-line or who do not share the same network security clearance. It is no longer included with Microsoft Office 2013. If still available it would likely fall under the EFSS quadrant.

Websphere MQ (message queue) or now just MQ is a middleware product, with limited MFT functionality. Primarily used only by large enterprises, it continues to be developed but isn’t considered an MFT solution.

Ipswitch was acquired by Progress in 2019 for +$200m for their MOVEit, WSFTP and WhatsUp Gold product lines. Ipswitch acquired Messageway in 2010 to add integration and EDI to their portfolio which now includes three separate file transfer product lines, but it appears to have become EOL.

Accellion, now known under the brand Kiteworks which was previously the name of their solution. Kiteworks main focus is still EFSS/Ad Hoc file sharing, although, its MFT capability has been significantly enhanced. Kiteworks private equity backing has allowed it to make a number of acquisitions of smaller file transfer companies during 2022 and 2023.

Now known as Hightail. Person-to-person file sync and share, suitable to the EFSS quadrant but not an MFT vendor.

Metastorm was acquired by OpenText in 2011. Not an MFT solution but a Business Process Management tool it doesn’t support the secure exchange of information, it is more geared up to internal approval workflows.

Axway acquired Tumbleweed, the developer of SecureTransport, in 2008 and has since been a significant player in the MFT industry. Their product portfolio includes all the key components of a mature MFT solution, with gateway, server, workflow engine, dashboards and agents. The biggest advantage for Axway is their very competitive subscription pricing policy especially if you’re looking for multiple instances (HA/DR). Axway is very strong in the financial and banking industry sectors.

CyberArk Sensitive Information Management (SIMS) is now end of life. Pro2col was consulted on the state of the MFT industry as they wanted to ensure the easiest transition for their customers, who are largely based in Israel.

Proginet CyberFusion Integration Suite: Acquired by Tibco Software in September of 2010 and now called Tibco MFT.

CA have a product called Automic Managed File Transfer, however it appears to have limited capabilities and the Automic product line is focused on Workload Automation. In the past fifteen years we’ve never found an organisation using an MFT solution from CA

Biscom’s main business is fax software, however, they have a secure email and file sync and share solution too. Biscom, recently acquired by Concord Technologies, is another vendor which should sit in the EFSS quadrant not MFT.

Primeur’s latest version of their MFT solution is DataOne, replacing Spazio. Primeur’s customer base is primarily located in Italy, where the company is based.

OpenText acquired EasyLink Services in May 2012. Their product has been integrated into OpenText’s Bizmanager portfolio.

Inovis were acquired by GXS in 2010 with their Bizmanager product becoming the B2B Gateway of choice for GXS.

nuBridges were acquired by Liaison Technologies in April 2011 and now forms part of Liaison ALLOY® Platform

SSH’s Tectia has never been an MFT solution. As the inventors of the protocol their server and client combination doesn’t provide a large number of features expected of more complete MFT solutions.

Box provides secure content management, workflow, and collaboration. Very much in the EFSS quadrant not an MFT solution.

GXS were acquired by OpenText in November 2013. Bizmanager, formerly an Invovis solution, was adopted as Opentext’s primary B2B gateway.

DataMotion’s primary technology is SecureMail for securing email exchanges with limited automation provided by DataBridge. It doesn’t have enough expected features to fit the profile of an MFT solution.

Stonebranch has a comprehensive workload automation tool and has recently added a file transfer server to their portfolio, to replace OEM’d products from Cleo and more recently Jscape.

Group Logic was acquired by Acronis in September 2012. MassTransit isn’t very feature rich, and looking through the release notes it appears to be in maintenance mode with no new features but minor enhancements and bug fixes over recent years.

iWay a wholely owned subsidiary of Information Builders continues to promote it’s Trading Partner Manager and wider iWay product portfolio. There doesn’t appear to be any focus on MFT though, however information is hard to find online and it’s a technology we’ve never seen.

No online presence, presumed ceased trading.

Messageway was acquired by Ipswitch in June 2010 providing Ipswitch with a broader integration and EDI capability. Since Progress’ acquisition of Ipswitch, Messageway appears to have become EOL.

Not one our experts were familiar with Momentum Systems, probably because it’s a quality management and business process management solution. Although like MFT, it has some integration and form capabilities.

A recent resurgence from bTrade has seen them adding senior executives to their team and investing in their online presence. We are waiting to review this technology to determine where to rank this established vendor.

ASG Workspaces provides online access to enterprise applications and information, together with collaborative and personal tools. Certainly not focused on MFT now and probably not in alignment with the EFSS quadrant either.

Repliweb was acquired by Attiunity in September 2011. Repliweb became EOL at the end of January 2022.

Leapfile is a secure email and file sharing solution with no MFT capabilities.

Tibco MFT is no longer being developed. Read more about our analysis here

SRT is an established vendor in the file transfer space and recently rebranded it’s MFT solution Cornerstone, to fall in line with their industry leading Titan SFTP server, to become Titan MFT.

Thru has evolved from being predominantly a secure email and collaboration tool, to the industry leading, cloud-first, Managed File Transfer platform. A notable milestone was being the first MFT vendor to integrate with iPaaS platforms Mulesoft and Boomi. They continue to focus on solving enterprise integration requirements

Open Text has acquired GXS, EasyLink, Metastorm and Liaison Technologies – which means they also acquired technology from Inovis and nuBridges.

NEXT STEPS

If you are looking for an MFT solution, it is important to do your research based on the current marketplace.

Most MFT solutions have the same features but differ in the level of detail and complexity, and how they are delivered. The only way you will be able to identify the right one for your business is to fully scope your requirements. Make sure you look at the vendor closely too and see what their previous development release schedule is like from published release notes. These are the factors that will determine whether your implementation is a success and will ensure you back a vendor that should meet your future needs too.

If you need help, use our free comparison tool, which asks the right questions. You enter your requirements, giving as much detail as you can, and our experts will recommend the right solution for your current and future needs and budget. It’s completely free and there’s no obligation to buy through us.

Further Reading:

Discover Your Ideal File Transfer Solution.

Take the risk out of selecting an MFT solution with our free, independent comparison service. Complete our short quiz and our experts will match you to your ideal solution.